-

Posts

989 -

Joined

-

Last visited

Content Type

Profiles

Texas Longhorns News

2025 Recruits

2024 Schedule

2026 Recruits

2025 Schedule

2027 Recruits

Gallery

Downloads

Forums

Blogs

Store

Everything posted by Kevin C

-

Loved the interview with Raja Bell on Coffee & Football yesterday. It was a good reminder for me that all recruits (and recruiting decisions) are not the same. Not even close, even in today’s world of NIL and big $$. While some players may be driven primarily by financials, and view their decision more as a business transaction, what matters most to other players truly is culture, relationships, resources, development, scheme, winning at the highest level and getting onto the field to prove they can contribute It was awesome to hear Raja talk yesterday about the relationships Dia began building with Sark, AJ and the staff going back to his first visit in Austin at the age of 13. The authentic way Dia felt the staff were all aligned and showed high character way before Dia was the player he is today, the thoughtful and innovative scheme and how Dia’s strengths fit Sark’s design as the visits progressed, Sark’s track record helping other QBs maximize their gifts, the Q&A with other players over the past couple years and how Raja and Dia’s mom felt like there was a consistency in what they heard from those other players re: resources provided to the players and what things are like when life isn’t all perfect. Because that’s reality. I especially enjoyed hearing Raja describe Sark’s patient and thoughtful approach throughout the process. While other coaches want to rush to the alter for a commitment, telling the player whatever it takes, Sark is more focused on building real relationships and telling players the truth, what they need to hear and determining if it’s a strong fit on both sides. Great job Gerry getting Raja Bell on the show. There was a strong resemblance to the family values we’ve witnessed from the Manning family interviews over the past couple years with the Bell family values. That came across by Raja yesterday. Work hard to be your best, stay grounded and humble, surround yourself with a strong inner circle, do the right thing. You could hear Dia’s character and work ethic shine as Raja talked about how Dia approached his rehab this past season and how he’s even stronger now than before. It really connects to Sark’s saying “Who you are some of the time is who you are all the time”. keep up the great work @Blake Munroe, @Gerry Hamilton and @Bobby Burton!! Hook em! 🧡🤘🏼🐂

-

Finished last season ranked #4 and Georgia #6 Texas went to back to back semi-finals. Georgia didn’t make semifinals either year Texas had #1 Recruiting Class, Georgia #2 in most current recruiting class. Texas had more wins and more NFL draft picks the past 2 yrs. Yes, we lost to h2h against Georgia last season (twice) but bigger picture, Texas (and Sark) aren’t getting manhandled by anyone, including Kirby and Georgia. Looking forward to playing at Georgia this season. Hook em! 🧡🤘🏼🐂

-

1yr ago on July 4th week, 2024 when Dakorien Moore, Josiah Sharma and Myron Charles all committed away from the good guys to Oregon and FSU, there was this exact same “Sky is falling, we suck, Kenny Baker and Chris Jackson can’t recruit” overreaction. By end of the recruiting cycle, we had the #1 class overall and our DL and WR groups were elite. Who knows how this class will turn out. I’m just saying Sark has enough track record now over the past 4yrs with hiring great coaches who can develop AND recruit, that I choose to be patient, ride the roller coaster, enjoy the ups and downs, focus on the wins and trust all will be ok in the end. if you prefer to overreact in the short-term while there’s still 5 months left in recruiting (plus the portal), that’s certainly one option. Hook em! 🧡🤘🏼🐂

-

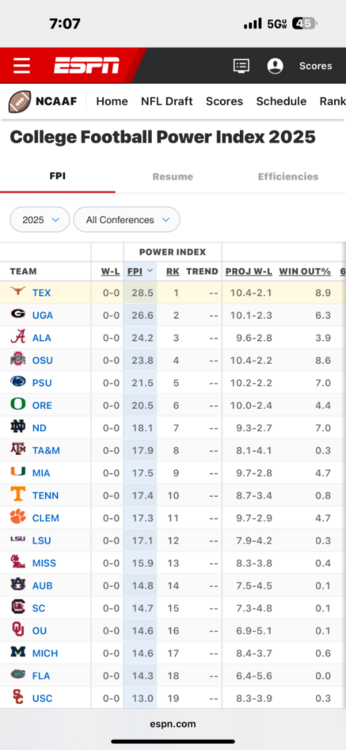

By comparison to the 9 ‘Top 16’ teams we could potentially play next season, Texas plays 4 teams this season in the Top 16 or 6 teams in the Top 22. Our conference schedule appears substantially easier this season by comparison, which is crazy. We aren’t in the Big 12 anymore, lol (and that is such a good thing).

-

Needed a mental break this morning from the Recruiting Roller Coaster. 🤪😂 Tip of the cap to you, Jeff Howe, with my expanded topic title this Sat morning, Lol. 😂🤣 Thinking about how dominating Texas will potentially be in 2026 on offense and defense with all our highly athletic freshmen and sophomores now ready to shine, it led me to look ahead at what our 2026 football schedule will potentially be and the questions it raises. 1) Will our SEC conference schedule be 8 or 9 games? Crazy that this question is still looming and TBD in mid-summer. 2) Will Texas have permanent annual games against 1, 2 or 3 teams? OU is absolute and I would think A&M is as well based on several comments made by CDC recently, regardless of whether the conference plays 8 or 9 SEC teams. I don’t have any feelings about Ark as a 3rd permanent annual game other than the fact that they are likely to be one of our easiest wins, given how competitive the SEC is top to bottom. 3) Assuming status quo of an 8-team conference schedule for 2026 and assuming Texas plays OU and A&M every year, 1 SEC team will get left out of the rotation to play Texas next season. Who would it be? 4) Given our current slate of conf games the past 2 seasons, 2026 would have Texas playing Bama, LSU, Ole Mis, Tennessee, A&M, OU, Missouri, South Carolina, Auburn. That’s 9 conference games. Who is gonna get left out? And btw, holy $&@?… 8 out of 9 teams in that group are ranked in the Top 16 currently according to ESPN’s FPI and the 9th (Missouri) is 24th. Then add to this insane 2026 conference schedule, our home game against Top 4 Ohio State to kick off the season. Texas is likely to have the #1 hardest schedule in football next season. 5) I’ve had it my mind this offseason that 2026 is Texas’ year to win it all due to anticipated younger players maturing and the belief that Texas would be more athletic and experienced (QB, OL, DL, Secondary, Receivers, TE, RB, etc) but…. 6) The reality is that our schedule may be more favorable this year (as crazy as that may sound) combined with the fact that the other top teams competing for a natty like Ohio State, Georgia, Notre Dame, Oregon, Bama, all have significant youth in key areas, including QB, as well. It brings me to 3 questions on this Saturday morning: 1) Is 2025 actually the year for Texas to win it ALL? Lots of things line up to say Yes imho, most notably our kick@$$ defense that should be second to none, an improved offense with Arch making us more diverse and dangerous, better special teams play (a real weakness last season that’s been addressed in the portal) and a schedule that’s more favorable. 2) If SEC only plays an 8-team conference schedule in 2026, who gets left off? 3) Can you think of any other time in history when it’s been more f’ing fun to be a Texas Longhorn? Hook em! 🧡🤘🏼🐂

-

OTF Premium OTF on the Road | Manning Passing Academy

Kevin C replied to CJ Vogel's topic in On Texas Football Forum

Klubnik should have a great year with those receivers. -

OTF Premium OTF on the Road | Manning Passing Academy

Kevin C replied to CJ Vogel's topic in On Texas Football Forum

That seems a little surprising. Arch likely still signing autographs at Bucee's on I-10 coming out of Houston. Line is 700+ people long, lol. 🤘🐂🧡 -

Agree. IMO, there’s no reason to be offended by any pre-season rankings. They’re fun to debate but the season will prove out and reality of performance is all that matters. I actually like that some of our key players and positions groups are getting overlooked (eg WR, TE, RB) going into the season. Time will tell but think this team is special and could achieve more than past 2 seasons, getting all the way to NC. Time will tell. 🧡🐂🤘🏼

-

Agree Paul. I’m buying a lot of stock pre-season on undervalued Longhorn WR /TE. Also, love hearing what’s being said about Tre Wisner for his commitment this spring to ‘take the bull by the horns’, put on some additional healthy muscle while also improving speed training. Perhaps all of Tre’s work this offseason can improve Tre from 4.7 ypc to 5.5 or 6 ypc and his total rushing/receiving yards could grow from 1375 total yards to 1600+ yds. Given what we’ve heard from Sark this week in interviews, he plans to be ultra careful this season with Baxter. I’m betting CJ isn’t at full stride till Nov then we’ll have a crazy 1-2 punch of Tre and CJ with additional support from Clark, Niblett, Baby Rhino, etc. Hook em! 🧡🤘🏼🐂

-

Hill(2), Simmons(4) and Taaffe(14) on defense Arch(16) only Longhorn on offense Thinking Arch is better than the 4th best QB in SEC. Time will tell. Also, thinking our trio of experienced receivers (Wingo, Mosley, Moore) will prove to be far better than low pre-season ratings. https://apple.news/Aydp_67jaQou5XodApDn3uA

-

Awesome Interview w/ Sark Yesterday on 3rd & Longhorn

Kevin C replied to Kevin C's topic in On Texas Football Forum

We were traveling all day yesterday, so not sure if this video was already posted. I didn’t see it on OTF. Thinking every player being recruited by Texas and their parents needs (yes, I’m sending this to the Crowell family with love 🧡) to watch this entire interview between Sark and several Longhorn greats. Between academics, team GpA up 3.31, Forbes tabbed UT as Ivy League of the South, true NIL earning potential (beyond the initial contract), long-term career opportunities in Austin after the NFL, player development, culture, NFL stock, winning championships, offensive scheme, creating his own legacy, playing with Manning, Lacey and Bell at QB, having Sark as your HC and OC, living in Austin, etc. So many reasons why UT, Austin and this coaching staff under Sark is the place for elite talent to be. Hook em!! 🧡🤘🏼🐂